You pay premiums month after month, hoping your beneficiaries will never need to claim (because the only way to “win” is for death to occur). Yet if nothing happens and you live a long, healthy life, you’re left staring at years of payments with nothing tangible to show for it. It’s a peculiar arrangement where you lose either way.

Let’s see why many Ghanaians call life insurance a “scam”.

Key Definitions

- Premiums: the money paid regularly to keep a policy active.

- Beneficiaries: the person(s) who receive the death benefit if you, the insured, pass away. They are usually your family and loved ones.

- Waiting periods: the time, usually 6 months, right after your policy starts, when full benefits are not available yet.

- Claims: the money paid to your beneficiaries if you, the insured, pass away.

Claims that add insult to injury

The worst time to deal with bureaucracy is when you’re grieving. Yet that’s exactly when beneficiaries find themselves digging through old files for original documents, completing mountains of paperwork, and joining customer service queues. What follows is often worse: No progress updates, no estimated timelines, just a painful wait while bills pile up.

When the payout finally arrives, it’s sometimes smaller than anticipated. Or denied entirely due to missed premium payments you were unaware of or clauses hidden in policy terms that no agent ever explained.

You pay for years and get nothing back

Think of life insurance as a way of preparing for the unexpected. Your family might need the payout when the unexpected happens, or you might live that long, happy life everyone hopes for. The frustration? That happy outcome means years of premium payments with zero return.

At the same time, cancelling your policy means all the money you have paid goes down the drain. Meanwhile, insurance companies post billions in profits, reinforcing the feeling that this system wasn’t designed with your best interests in mind.

The vanishing salesman

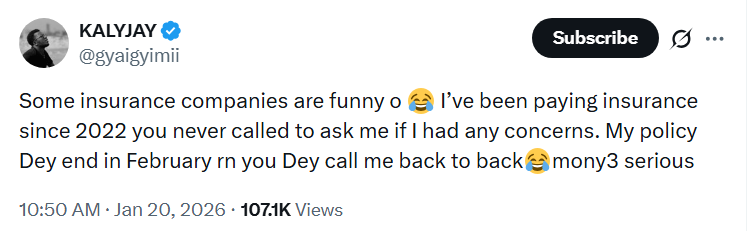

Social Media Influencer, KalyJay shares his thoughts (Credits: @gyaigyimii on X)

The sales experience doesn’t help. Almost everyone has encountered that “black suit in the hot sun” guy: the persistent agent who corners you with guilt-laden questions about protecting your family. He calls relentlessly until you give in and sign up. The moment your payment clears, he disappears. Those questions about waiting periods and coverage limits? You’re on your own.

But guess what? Life insurance does work.

Insurers pay out hundreds of billions in claims every year. The problem isn’t whether policies pay out, it’s how unnecessarily difficult the entire experience has become.

What Good Life Insurance Should Look Like

Digital-first claims processing

Modern life insurance should handle claims digitally with real-time updates at every step. No hunting for documents, no endless queues, no weeks of silence. Transparency should be the default.

Automated payment systems linked to mobile money or bank accounts eliminate the lapse problem entirely. The goal: make it impossible to accidentally lose coverage.

Policies that give something back

The “pay for years, get nothing” problem has solutions. Look for return-on-premium features or hybrid products combining protection with savings components. The best policies don’t force you to choose between protection and getting something back.

Lifetime support, not vanishing salespeople

Sales shouldn’t end at the signature. Quality insurers provide continuous access to advisors throughout your policy term through digital platforms that let you manage everything from an app.

Would you still think insurance is a scam if you had all this?

How We’re Approaching This at achieve by Petra

In partnership with Prudential Ghana, we’ve digitized two products around these principles. PruWealth and Farewell offer return-on-premium features, fully digital and transparent claims and lifetime support and guidance. Be part of this new and exciting shift in how life insurance works.

PruWealth

- Covers you and your spouse

- Choose a cover amount from GHS 100,000+

- Guaranteed lumpsum payout at maturity if no claim is made

Farewell

- Covers you, your spouse, up to 4 kids, plus parents and in-laws

- Choose a cover amount from GHS 20,000 to GHS 100,000

- Lumpsum pay out to cover funeral costs for you and your loved ones.